Members of the option community have for some years touted implied volatility as the “new asset class,” so it was probably inevitable that their creative energies would turn to implied correlation as the “new, new asset class.” Volatility is relatively easy to trade, using options straddles, for example, and the CBOE’s 2003 launch of the “new” VIX Index and related derivatives, which are essentially just synthetic straddles, simply offered convenience rather than a revolutionary new opportunity to traders. Structuring option positions that provide directional exposure to correlation is more difficult, and such trades were uncommon among any but the most sophisticated option arbitrageurs until the designers at the CBOE launched the S&P 500 Implied Correlation Index last year.

The Index is a synthetic dispersion trade. In a structure that is bullish on correlation, long positions in call options on a basket of index components are hedged with short positions in calls on the index. A bearish view on correlation would reverse the long and short positions. It is essential that the basket of long calls be optimized to replicate the trading behavior of the index as closely as possible – the CBOE Index employs fifty positions, rebalanced monthly – which explains why relatively few traders exploited this structure in the past. The way the structure works is that the index position hedges away the β of the individual components, so that what remains is their specific risk. When this decreases relative to their β, correlation increases; when it increases relative to their β, correlation declines.

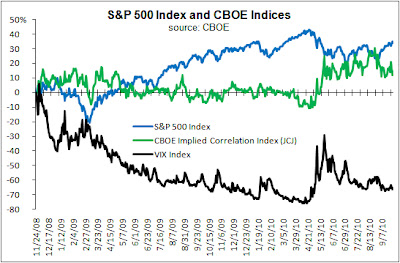

Predictably, correlation counter-correlates with the underlying S&P 500 Index, but not nearly as much as volatility does: the coefficient of correlation was -0.4075 for the January 2011 Correlation Index (11/25/08 - 9/27/10; ticker JCJ) compared to -0.7280 for the VIX Index. Also as would be expected, correlation was considerably less volatile than the VIX during the same period (annualized standard deviations of 47.9% and 110.9%, respectively), although it is somewhat surprising that correlation had nearly twice the 26.5% volatility exhibited by the underlying S&P 500 Index.

As with the VIX Index, it is important to remember that the Correlation Index is an option-implied statistic, and that its value as a predictor of actual outcomes is limited. Both tend to imply outcomes that are higher than they actually turn out to be, although they may on occasion undershoot the actual outcome, as they both have done recently. An article by Theo Casey in Futures and Options Intelligence (requires registration) argues that the current high levels of correlation can be ascribed to ETF trading, and there may be some merit in this. However, he also raises the possibility that this heralds a fundamental change in the structure of the equity markets. However, the high levels of activity in ETFs are themselves a result of current market conditions, and likely to change. Over its 23 month life, JCJ has traded as low as 19.92 and as high as 81.09. It does not seem likely that it is the bellwether of a consistently highly correlated market.

Wednesday, September 29, 2010

Saturday, September 18, 2010

Prime Office Real Estate

Institutional interest in prime office buildings has been strong since the end of last year. This is not surprising: cap rates (annual lease rates ÷ capital costs) are high, while the yield on competing investments in quality corporate bonds is hardly compelling. There is a widespread perception that prime locations can be picked up at distressed prices, offering the prospect of capital gain in addition to a solid income stream. Vacancy rates in most markets, while elevated, are not extreme, and there is little supply coming on stream from new construction in most of them, suggesting that lease rates will remain firm provided that vacancies do not rise. There are reasonable grounds for confidence that they will not, if only because they have failed to do so during the worst of the recession: lessees are either warehousing space for future needs or using space less intensively than they had in recent years. Finally, the inflation-protective aspect of real estate is attracting institutions that require current income (such as those with distribution requirements), since they are otherwise challenged to find such protection from income-producing instruments other than TIPS.

Thus the investment case in favor of office real estate is fairly strong, and prime structures, which have always attracted the bulk of institutional real estate interest, are the principle beneficiaries of it. General Partners of private real estate vehicles have been quick to launch new funds to accommodate this interest. However, investors in these funds are likely to find that it is difficult for their General Partners to find investments in which to deploy their capital. Property owners are naturally resistant to selling at what they also perceive as depressed prices. The flood of distressed selling that many investors anticipated has not materialized, as lenders have preferred to renegotiate rather than to foreclose, doubtless influenced by the same perception of the potential value of their collateral, as well as the substantial costs of foreclosure. The gradual recovery of the CMBS market will do nothing to discourage this preference, since it increases the liquidity of lenders’ positions and offers the prospect that, if they need to, lenders will be able to exit their positions on better terms than they could achieve through foreclosure and re-sale. As is frequently the case with depressed real estate markets, there is a constellation of interests that prevents the market from clearing rapidly. Thus opportunities to acquire prime office properties cheaply are less abundant than many institutions had expected.

The inevitable result will be that returns on the current vintage of prime office funds will be less than their most optimistic investors had hoped. Will they be less than their required rates of return? From the trough in Q4 1993 to the peak in Q2 2008 shown in the chart above, annual total returns from office properties were a quite satisfactory 8.9%, while for the whole period shown, including two drawdowns of 23% and 36%, the total return was a still-respectable 5.9%. The recent slump was more severe than the 1990 - 1993 decline, and recovery has been more rapid. Fundamental conditions – cap and vacancy rates, foreseeable newbuilding – support a return forecast that is at least as attractive as the 1993 - 2008 trough-to-peak experience. The major imponderable is the behavior of investors themselves. If institutional money continues to flood into the prime office sector, and owners continue to resist distressed sales, much of the price recovery will redound to the benefit of the existing owners and their creditors rather than the current vintage of new funds.

The speed with which returns have begun to recover suggests that this is precisely what is happening. If their required return is above, say, 6.5%, uncommitted investors would probably be wise to broaden their real estate search beyond prime U.S. office space to other building types, geographies or investment strategies. For example, the state of the market in the prime segment suggests that conditions for “value added” investment in office structures – those that require refurbishment – are close to ideal. Of course, if the “value added” office segment attracts significant institutional inflows, this will further dampen returns on prime office buildings, since the effect of “value added” investment is to increase the supply of prime office space through repositioning the buildings purchased.

Thus the investment case in favor of office real estate is fairly strong, and prime structures, which have always attracted the bulk of institutional real estate interest, are the principle beneficiaries of it. General Partners of private real estate vehicles have been quick to launch new funds to accommodate this interest. However, investors in these funds are likely to find that it is difficult for their General Partners to find investments in which to deploy their capital. Property owners are naturally resistant to selling at what they also perceive as depressed prices. The flood of distressed selling that many investors anticipated has not materialized, as lenders have preferred to renegotiate rather than to foreclose, doubtless influenced by the same perception of the potential value of their collateral, as well as the substantial costs of foreclosure. The gradual recovery of the CMBS market will do nothing to discourage this preference, since it increases the liquidity of lenders’ positions and offers the prospect that, if they need to, lenders will be able to exit their positions on better terms than they could achieve through foreclosure and re-sale. As is frequently the case with depressed real estate markets, there is a constellation of interests that prevents the market from clearing rapidly. Thus opportunities to acquire prime office properties cheaply are less abundant than many institutions had expected.

The inevitable result will be that returns on the current vintage of prime office funds will be less than their most optimistic investors had hoped. Will they be less than their required rates of return? From the trough in Q4 1993 to the peak in Q2 2008 shown in the chart above, annual total returns from office properties were a quite satisfactory 8.9%, while for the whole period shown, including two drawdowns of 23% and 36%, the total return was a still-respectable 5.9%. The recent slump was more severe than the 1990 - 1993 decline, and recovery has been more rapid. Fundamental conditions – cap and vacancy rates, foreseeable newbuilding – support a return forecast that is at least as attractive as the 1993 - 2008 trough-to-peak experience. The major imponderable is the behavior of investors themselves. If institutional money continues to flood into the prime office sector, and owners continue to resist distressed sales, much of the price recovery will redound to the benefit of the existing owners and their creditors rather than the current vintage of new funds.

The speed with which returns have begun to recover suggests that this is precisely what is happening. If their required return is above, say, 6.5%, uncommitted investors would probably be wise to broaden their real estate search beyond prime U.S. office space to other building types, geographies or investment strategies. For example, the state of the market in the prime segment suggests that conditions for “value added” investment in office structures – those that require refurbishment – are close to ideal. Of course, if the “value added” office segment attracts significant institutional inflows, this will further dampen returns on prime office buildings, since the effect of “value added” investment is to increase the supply of prime office space through repositioning the buildings purchased.

Saturday, September 11, 2010

CalPERS’ Proposed Investment Classification

As mentioned in my book, CalPERS has been studying the idea of reclassifying its investments for the purpose of adding clarity to its asset allocation efforts. Pensions & Investments Online reports that CalPERS suggests the reclassification shown below, although this may not be its final form: the proposal is contained in a memo that will be considered at a November meeting of its Investment Committee, and differs from an earlier proposal that was floated in March.

The reclassification is clearly a move away from an asset class-based schema toward a more functional classification of investments. Although the old classification included one category – inflation-protective – that is clearly functional in nature, the new classification includes four functional categories, with only “real assets” as an asset class-based category.

The inadequacies of an asset class-based schema are abundantly clear to any Investment Committee that has struggled with one, and CalPERS has made a laudable attempt to circumvent them. It would be unfair to nit-pick over the proposed reclassification, since it may still be subject to modification, the details of how its categories will be defined remain unclear and how allocation based upon them will be implemented has not been discussed. However, it is not just an aesthetic objection that the proposed reclassification retains an asset class-based category.

The point of a functional classification is to underline the portfolio role of the instruments that comprise the investable universe. The function-based categories that CalPERS has defined pretty much cover the essential tasks that a portfolio must perform on behalf of the institution:

• to preserve capital against inflation and deflation or credit crisis;

• to provide current income to meet distribution requirements and to enhance tactical flexibility; and

• to increase the endowment to allow the institution to expand its activities if its trustees so choose.

Many, if not most, investments exhibit characteristics that help fulfill more than one of these functions – dividends, for instance, provide income from the “growth” allocation that is surely welcome. But this can be accommodated within the schema by distinguishing between investments’ primary and secondary portfolio roles. So where does the asset class-based category of “real assets” fit in? Investments in this category will presumably be selected in order to perform one or more of the essential portfolio functions – if not, why allocate to them at all? So CalPERS’ unwillingness to follow the logic of its proposed classification system and restrict itself to four functional categories seems inconsistent.

The advantage of functional classification is that it puts first things first: optimization among asset classes is not the first priority of an Investment Committee. Before it reaches any decisions regarding the disposition of its assets, a Committee should ponder what it wants to accomplish with the resources at hand. For example, if it is an inescapable duty to make a 7% distribution of assets in each of the next three years, questions of the disposition of its portfolio resources must follow from that requirement. If it is an immature defined benefit program, the Committee is instead likely to focus on the pursuit of growth. The appropriate asset allocation follows from such decisions, so classifying investments by their portfolio function aids the Investment Committee in performing its primary task.

It is in this context that CalPERS’ retention of a “real assets” category seems odd. Maintaining positions in real assets is not a function that an institution needs to accomplish: they, like any other investments, are means to an end. Timberland and infrastructure are primarily income-producing investments, but with a measure of inflation protection. Real estate as a broad category encompasses prime office buildings, with similar characteristics, but also development projects that more closely resemble growth equity. The logic of CalPERS’ classification schema suggests that investment categories that fall under “real assets” should be redistributed.

There is at least one category of investments – one so-called asset class – that poses significant challenges to CalPERS’ functional schema: “absolute return.” Presumably it provides some protection against inflation (if it cannot produce a real return, why invest in it at all?). A real return is clearly a minimum requirement for investments that fit into the “growth” category, but investments that can only meet this minimum standard represent rather poor candidates for fulfilling the function of increasing the endowment. Although its returns may be “absolute” in most market conditions, its tail risks tend to be closely related to those of the assets on which its strategies are employed, so its adequacy as a hedge is debatable. Few such investments provide current income. CalPERS’ proposal has generated some controversy, and I suspect that not the least reason for this is that it cannot find a natural classification for “absolute return.” This begs the question of whether this is in fact a flaw, or carries the unexpected implication that “absolute return” does not fulfill any essential portfolio functions very well.

The reclassification is clearly a move away from an asset class-based schema toward a more functional classification of investments. Although the old classification included one category – inflation-protective – that is clearly functional in nature, the new classification includes four functional categories, with only “real assets” as an asset class-based category.

The inadequacies of an asset class-based schema are abundantly clear to any Investment Committee that has struggled with one, and CalPERS has made a laudable attempt to circumvent them. It would be unfair to nit-pick over the proposed reclassification, since it may still be subject to modification, the details of how its categories will be defined remain unclear and how allocation based upon them will be implemented has not been discussed. However, it is not just an aesthetic objection that the proposed reclassification retains an asset class-based category.

The point of a functional classification is to underline the portfolio role of the instruments that comprise the investable universe. The function-based categories that CalPERS has defined pretty much cover the essential tasks that a portfolio must perform on behalf of the institution:

• to preserve capital against inflation and deflation or credit crisis;

• to provide current income to meet distribution requirements and to enhance tactical flexibility; and

• to increase the endowment to allow the institution to expand its activities if its trustees so choose.

Many, if not most, investments exhibit characteristics that help fulfill more than one of these functions – dividends, for instance, provide income from the “growth” allocation that is surely welcome. But this can be accommodated within the schema by distinguishing between investments’ primary and secondary portfolio roles. So where does the asset class-based category of “real assets” fit in? Investments in this category will presumably be selected in order to perform one or more of the essential portfolio functions – if not, why allocate to them at all? So CalPERS’ unwillingness to follow the logic of its proposed classification system and restrict itself to four functional categories seems inconsistent.

The advantage of functional classification is that it puts first things first: optimization among asset classes is not the first priority of an Investment Committee. Before it reaches any decisions regarding the disposition of its assets, a Committee should ponder what it wants to accomplish with the resources at hand. For example, if it is an inescapable duty to make a 7% distribution of assets in each of the next three years, questions of the disposition of its portfolio resources must follow from that requirement. If it is an immature defined benefit program, the Committee is instead likely to focus on the pursuit of growth. The appropriate asset allocation follows from such decisions, so classifying investments by their portfolio function aids the Investment Committee in performing its primary task.

It is in this context that CalPERS’ retention of a “real assets” category seems odd. Maintaining positions in real assets is not a function that an institution needs to accomplish: they, like any other investments, are means to an end. Timberland and infrastructure are primarily income-producing investments, but with a measure of inflation protection. Real estate as a broad category encompasses prime office buildings, with similar characteristics, but also development projects that more closely resemble growth equity. The logic of CalPERS’ classification schema suggests that investment categories that fall under “real assets” should be redistributed.

There is at least one category of investments – one so-called asset class – that poses significant challenges to CalPERS’ functional schema: “absolute return.” Presumably it provides some protection against inflation (if it cannot produce a real return, why invest in it at all?). A real return is clearly a minimum requirement for investments that fit into the “growth” category, but investments that can only meet this minimum standard represent rather poor candidates for fulfilling the function of increasing the endowment. Although its returns may be “absolute” in most market conditions, its tail risks tend to be closely related to those of the assets on which its strategies are employed, so its adequacy as a hedge is debatable. Few such investments provide current income. CalPERS’ proposal has generated some controversy, and I suspect that not the least reason for this is that it cannot find a natural classification for “absolute return.” This begs the question of whether this is in fact a flaw, or carries the unexpected implication that “absolute return” does not fulfill any essential portfolio functions very well.

Sunday, September 5, 2010

Reports of the Death of Mean Reversion are Exaggerated

Many investment strategies employ techniques that identify potentially attractive trades on the assumption that prices revert to a central trend, generally referred to as a ‘mean,’ although it may not actually have that mathematical pedigree. The claim for these techniques is that prices can be expected to pull back from the extremes to which supply or demand may push them, and that isolating a sufficiently stable central tendency allows traders to identify and exploit such reversions. For at least a year now, this assumption has been under strain in various markets.

Before proceeding further, however, there is a red herring to dispose of. In an August 2 Financial Times editorial, Richard Clarida and Mohamed El-Erian of Pimco muddy the waters by arguing from the extreme dispersion of current economic opinion – deflation vs. hyperinflation, recovery vs. recession – to the conclusion that investors will flee investment techniques that rely on some historical measure of value to which prices revert. Their reasoning is unsound. From a wide disparity of economic expectations it follows that there is a wide disparity of opinion on where value is to be found – but it does not follow that value itself is widely dispersed. Value is a matter of economic outcomes, not economic perceptions. Some forecasts will turn out to be correct, leading their adherents to value and attractive returns, while others will turn out to be wrong, suggesting value where in fact there is none (the bond market, perhaps?). Confusion over the economic outlook may cause investors to despair over their ability to identify sources of value, but it does not follow that there is no value to be found.

The issue regarding mean reversion does not relate to valuation but to technical analysis and algorithmic trading, particularly over the short time horizons employed by high frequency traders and statistical arbitrageurs. By definition, any procedure used to derive a central price tendency – whether it is a moving average, the arithmetic mean relative to which standard deviation is calculated, or what-have-you – must take time series data for its inputs. The longer the time series – the greater the number of observations used in the function or algorithm used to define the tendency – the less volatile the central value will be. That is, the longer the series, the less the next observation will cause the trend to shift, even if it diverges very sharply from the tendency. The effect of this “dilution” of recent observations can be compensated by various methods of weighting them more heavily than earlier ones, but it cannot be completely eliminated.

Since they are unavoidably lagging indicators, in periods of high volatility these central tendencies may not be of much value to traders. This is especially true when markets are volatile over several time horizons – day to day, week to week and month to month – and when their volatility is itself volatile, increasing and decreasing rapidly. In the charts below, standard deviation is calculated over ninety observations, which is about the shortest series that allows for statistical significance. It does not take much imagination to see why it would be difficult for mean reversion techniques to thrive in the U.S. equity market since April of this year. For much of the period those who rely on mean reversion were subject to frequent false signals or no meaningful signals at all.

All investment managers experience periods during which their discipline is not rewarded by their market’s characteristics. In some cases these periods can be quite protracted, inevitably causing them much soul-searching and not a little despondency. Managers without access to alternative trade identification procedures to fall back on may even be forced to close shop before conditions become more favorable to them. But conditions will eventually change, and if in the meantime the ranks of traders reliant on mean reversion trading signals have been thinned, the reward to mean reversion techniques will be that much greater.

Before proceeding further, however, there is a red herring to dispose of. In an August 2 Financial Times editorial, Richard Clarida and Mohamed El-Erian of Pimco muddy the waters by arguing from the extreme dispersion of current economic opinion – deflation vs. hyperinflation, recovery vs. recession – to the conclusion that investors will flee investment techniques that rely on some historical measure of value to which prices revert. Their reasoning is unsound. From a wide disparity of economic expectations it follows that there is a wide disparity of opinion on where value is to be found – but it does not follow that value itself is widely dispersed. Value is a matter of economic outcomes, not economic perceptions. Some forecasts will turn out to be correct, leading their adherents to value and attractive returns, while others will turn out to be wrong, suggesting value where in fact there is none (the bond market, perhaps?). Confusion over the economic outlook may cause investors to despair over their ability to identify sources of value, but it does not follow that there is no value to be found.

The issue regarding mean reversion does not relate to valuation but to technical analysis and algorithmic trading, particularly over the short time horizons employed by high frequency traders and statistical arbitrageurs. By definition, any procedure used to derive a central price tendency – whether it is a moving average, the arithmetic mean relative to which standard deviation is calculated, or what-have-you – must take time series data for its inputs. The longer the time series – the greater the number of observations used in the function or algorithm used to define the tendency – the less volatile the central value will be. That is, the longer the series, the less the next observation will cause the trend to shift, even if it diverges very sharply from the tendency. The effect of this “dilution” of recent observations can be compensated by various methods of weighting them more heavily than earlier ones, but it cannot be completely eliminated.

Since they are unavoidably lagging indicators, in periods of high volatility these central tendencies may not be of much value to traders. This is especially true when markets are volatile over several time horizons – day to day, week to week and month to month – and when their volatility is itself volatile, increasing and decreasing rapidly. In the charts below, standard deviation is calculated over ninety observations, which is about the shortest series that allows for statistical significance. It does not take much imagination to see why it would be difficult for mean reversion techniques to thrive in the U.S. equity market since April of this year. For much of the period those who rely on mean reversion were subject to frequent false signals or no meaningful signals at all.

All investment managers experience periods during which their discipline is not rewarded by their market’s characteristics. In some cases these periods can be quite protracted, inevitably causing them much soul-searching and not a little despondency. Managers without access to alternative trade identification procedures to fall back on may even be forced to close shop before conditions become more favorable to them. But conditions will eventually change, and if in the meantime the ranks of traders reliant on mean reversion trading signals have been thinned, the reward to mean reversion techniques will be that much greater.

Subscribe to:

Posts (Atom)